Mutual Funds have gained rapid popularity as a good investment vehicle and public at large is attracted towards MF investment, which has variety of schemes and income options offered by Mutual Funds which can suit the financial preferences of all classes of investors, be it Retail, Corporate or Institutional.

The robust performance of the industry comes on the back of growing investor awareness and increased investments in Systematic Investment Plans (SIPs).

AMFI data shows that the Industry’s AUM crossed the milestone of Rs 10 Trillion (Rs 10 Lakh Crore) for the first time as on 31st May 2014 and in a short span of about three years the AUM size had increased more than two folds and crossed Rs 20 trillion (Rs 20 Lakh Crore) for the first time in August 2017. The AUM size crossed Rs 30 trillion (Rs 30 Lakh Crore) for the first time in November 2020. The Industry AUM stood at Rs.72.20 Trillion (Rs. 72.20 Lakh Crore) as on May 31, 2025.

The overall size of the Indian MF Industry has grown from Rs 12.04 trillion as on 31st May 2015 to Rs 72.20 trillion as on 31st May 2025, more than 6 fold increase in a span of 10 years.

The overall size of the Indian MF Industry has grown from Rs 24.55 trillion as on 31st May 2020 to Rs 72.20 trillion as on 31st May 2025, approximately 3 fold increase in a span of 5 years.

The number of investor folios have gone up from 9.10 crore folios as on 31st May 2020 to 23.83 crore as on 31st May 2025, more than 2.5 fold increase in a span of 5 years.

On an average 24.55 lakh new folios are added every month in the last 5 years since May’2020.

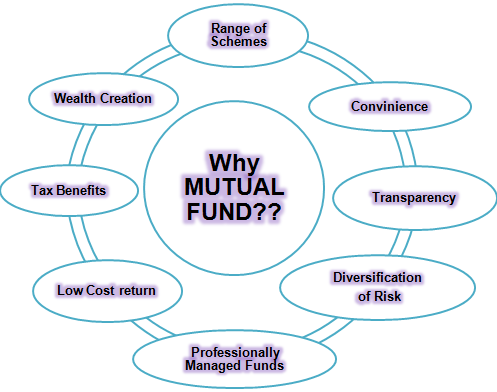

The following benefits, intrinsic to investments in Mutual Funds have inspired greater confidence amongst the investors:-